Natalie Behring

The Chinese regulators decided to suspend the initial public offering of Ant Group's financial company on the Star Market (part of the Shanghai Stock Exchange), which was to take place on 5 November. This was announced by Ant Group itself on the Hong Kong Stock Exchange website.

China's core regulators considered that the company may not meet the disclosure requirements or conditions for the IPO. These concerns are linked to "significant issues" that have arisen as a result of a conversation between the regulators and the controlling party, the company's chairman and CEO, the report said. In addition, there have been "recent changes in the regulation of the financial sector," the company writes.

Due to the suspension of the IPO in Shanghai, the simultaneous listing on the Hong Kong Stock Exchange will also be suspended, Ant Group added. It did not specify for how long the IPO has been suspended.

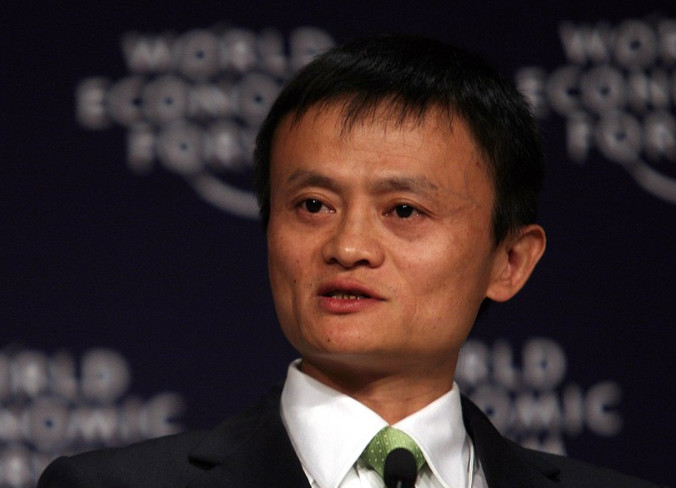

On Monday, the People's Bank of China, along with three other regulators, called in the founder of Ant Group, billionaire Jack Ma, who now controls the company, as well as its charimen, to question them about the IPO. The details of the interview were not disclosed. Ant Group only specified that it would "carefully apply the views expressed at the meeting".

The Shanghai Stock Exchange wrote in a statement on its website that Jack Ma was called in for "control interviews" and that "other significant problems" have arisen, including changes in the "regulatory environment for financial technology," the Financial Times quoted.

Ant Group planned the largest IPO ever in both Shanghai and Hong Kong for 5 November, with the expectation of raising $34.4 billion. The record now belongs to Saudi Aramco, the world's largest oil company, which was able to raise $29.4 billion for an IPO. The upcoming offering caused a lot of excitement: the offering attracted at least $3 trillion in bids from individual investors, Bloomberg wrote.

source: ft.com, bloomberg.com

China's core regulators considered that the company may not meet the disclosure requirements or conditions for the IPO. These concerns are linked to "significant issues" that have arisen as a result of a conversation between the regulators and the controlling party, the company's chairman and CEO, the report said. In addition, there have been "recent changes in the regulation of the financial sector," the company writes.

Due to the suspension of the IPO in Shanghai, the simultaneous listing on the Hong Kong Stock Exchange will also be suspended, Ant Group added. It did not specify for how long the IPO has been suspended.

On Monday, the People's Bank of China, along with three other regulators, called in the founder of Ant Group, billionaire Jack Ma, who now controls the company, as well as its charimen, to question them about the IPO. The details of the interview were not disclosed. Ant Group only specified that it would "carefully apply the views expressed at the meeting".

The Shanghai Stock Exchange wrote in a statement on its website that Jack Ma was called in for "control interviews" and that "other significant problems" have arisen, including changes in the "regulatory environment for financial technology," the Financial Times quoted.

Ant Group planned the largest IPO ever in both Shanghai and Hong Kong for 5 November, with the expectation of raising $34.4 billion. The record now belongs to Saudi Aramco, the world's largest oil company, which was able to raise $29.4 billion for an IPO. The upcoming offering caused a lot of excitement: the offering attracted at least $3 trillion in bids from individual investors, Bloomberg wrote.

source: ft.com, bloomberg.com