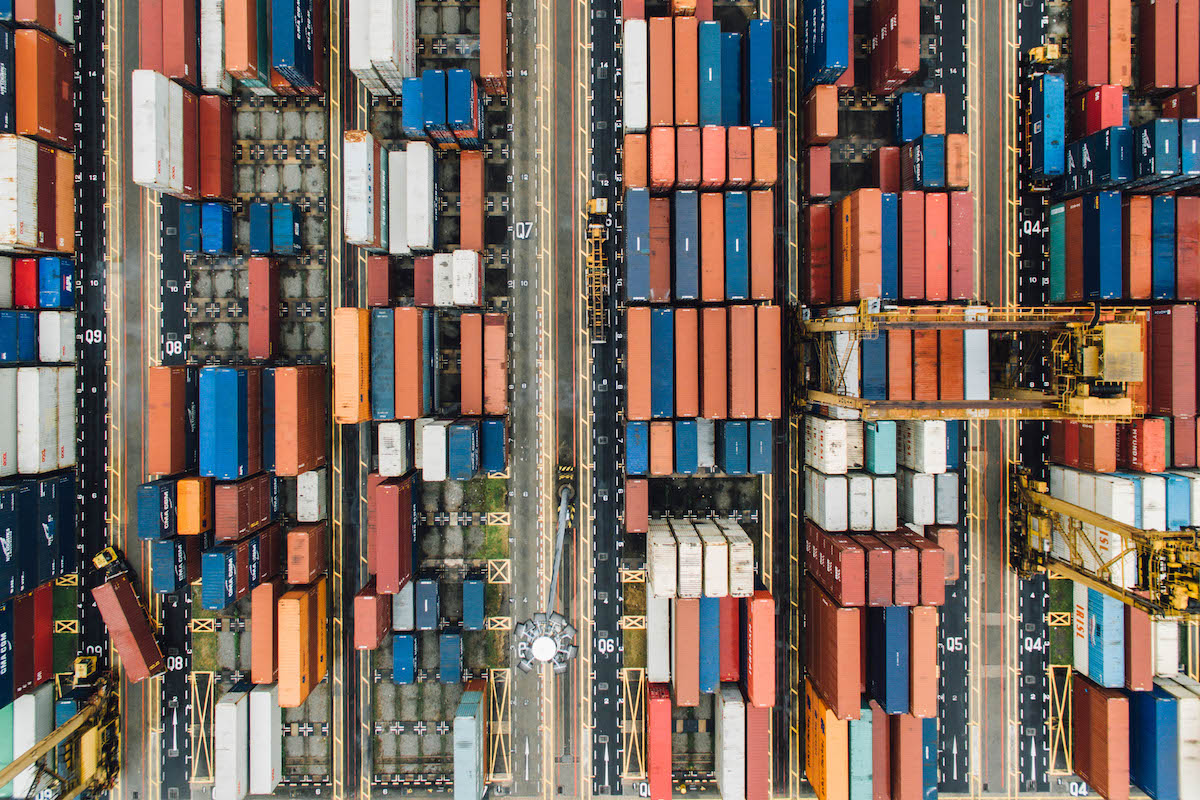

BofA’s February survey by of 205 managers holding $485 billion in assets found that 39% of those surveyed identified a trade war as the greatest risk to the global economy in the year ahead. That's an increase of 11 percentage points since January. The risk of inflation and a Fed rate increase secured the second position (31%).

Investor sentiment shifted following the initial actions of Donald Trump's administration, which declared the implementation of tariffs on products from Mexico, Canada, and China. Beijing replied with retaliatory actions, escalating tensions.

Even with the dangers involved, managers keep decreasing cash reserves by boosting equity investments. This suggests a quest for returns amid uncertainty, even though the more stable markets of the US and Europe are preferred

source: bloomberg.com

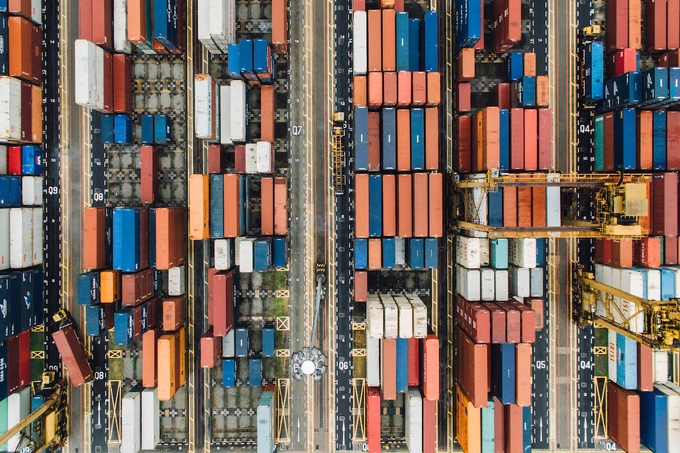

Investor sentiment shifted following the initial actions of Donald Trump's administration, which declared the implementation of tariffs on products from Mexico, Canada, and China. Beijing replied with retaliatory actions, escalating tensions.

Even with the dangers involved, managers keep decreasing cash reserves by boosting equity investments. This suggests a quest for returns amid uncertainty, even though the more stable markets of the US and Europe are preferred

source: bloomberg.com