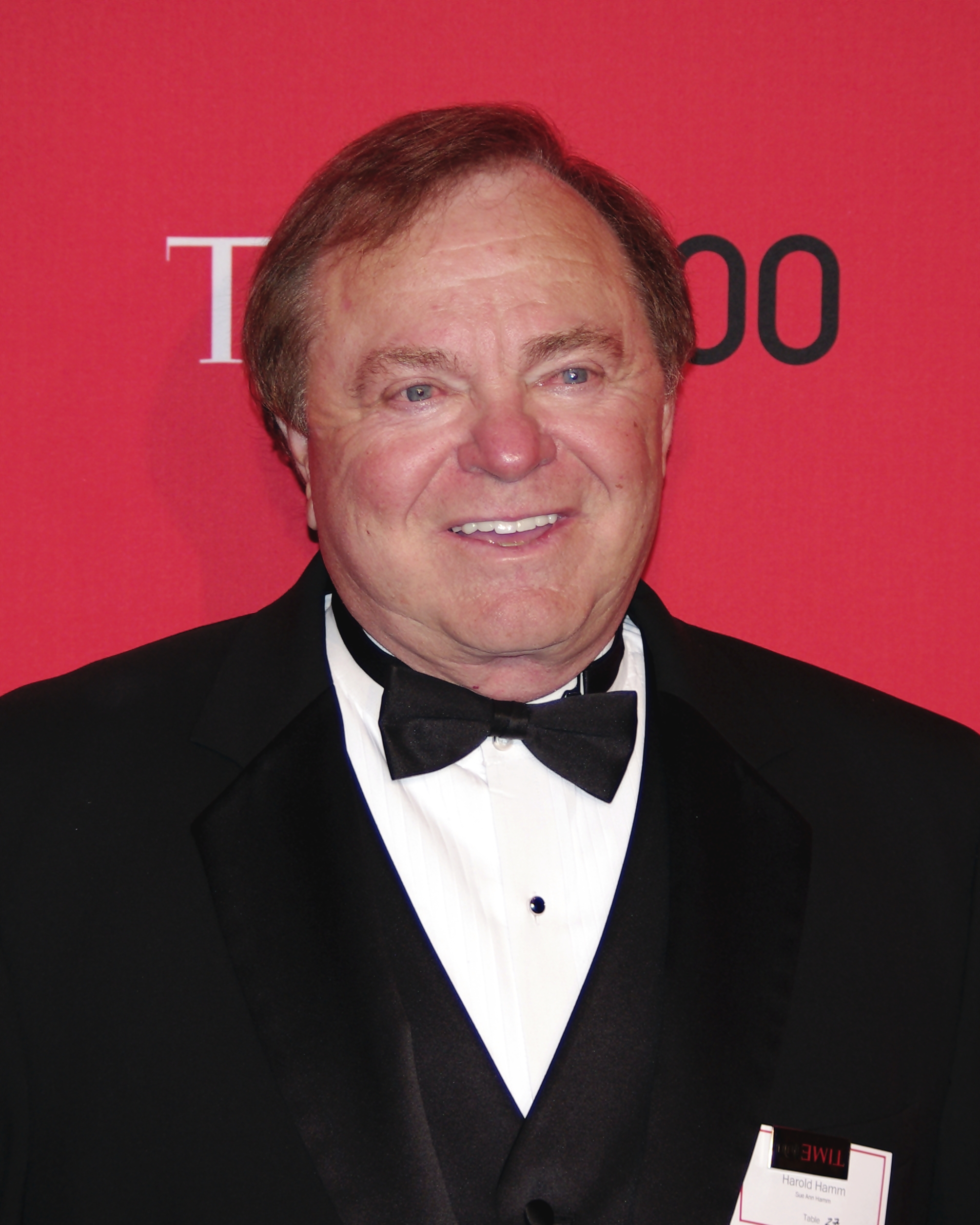

From the beginning of the year, the American billionaire Harold Hamm lost $ 889 million, indicates Bloomberg Billionaire Index. Bloomberg estimates state of the businessman, who made his fortune in oil shale, to $ 6 billion. Forbes is more modest – according to the journal, Hamm possesses "only" $ 4.3 billion. In his public speeches and interviews, Hamm acknowledges that he has suffered from a sharp decline in oil prices in late 2015 - early 2016 year, but hopes for a quick recovery. He is waiting the quotes to jump up to $ 60 per barrel by the end of this year.

The 70-year-old billionaire has already coped with a long period of cheap oil. Just like many high achievers, he sees the crisis not as a difficulty, but an opportunity for expansion. In Forbes’ ranking of "independence" to achieve wealth, Hamm assigned the highest score - 10. It means that a person could succeed with minimal starting opportunities.

"Wild Driller"

Born of the town of Lexington, Oklahoma, which population barely exceeded one thousand in the early 1960s, Hamm had to make a choice between being a farmer like his sharecroppers parents, or escape from the provinces and go to university. As he would say later, "I do not look back". He got married being 17 years old, and moved with his family to a bigger city Enid, where he got a temporary job. Cleaning and filling machines brought him a dollar an hour, which was enough to pay for an education loan.

In the early 1960s, North Oklahoma experienced an oil boom. Hamm was lucky - two years after graduating from high school, he managed to become an oilman in Champlin Oil with a fixed salary of $500 a month. "It was a job, which everyone wanted," - he later recalled. Already in 1967, Hamm founded his own oil company, Shelly Dean Oil Co., the predecessor of the current Continental Resources, 76% of which shares he possesses to this day.

The company’s first "office" was located in his Ford pickup truck. Bloomberg describes his working day: "During the day he was cleaning out the water from the oil reservoir, and in the early morning and late evening sitting with worn down by life drillers and learned to decipher the data of drilling logs." He drilled his first well in Oklahoma in the early 1970s, and the second well gushed with oil. Level of production from the second one reached 75 barrel a hour. "It was noticed by everyone," - he said to Forbes in 2012.

He spent money earned on the first oil on learning courses of geology, chemistry and mineralogy. Hamm did not get a university diploma, but that does not prevent him to consider himself as a geologist. He enthusiastically talks about rock porosity and is personally involved in analyzes of samples and planning exploration.

The company’s heyday fell on the 1990s, when Bakken oil field was discovered in North Dakota. This discovery was the largest since Prudhoe Bay in Alaska in 1968. However, developing demanded new technologies, precisely, hydraulic fracturing that would produce previously unavailable raw material. "He supports all new technologies, - told Bloomberg head of exploration units Jack Stark. - He rents a piece of land and tests the idea on the spot. Others are reluctant to act. "

"He's one of the smartest oil people, whom I met - confessed Lew Ward, Ward Petroleum Chairman, who knows Hamm since their youth in Enid. - He thinks and acts faster than an average person."

Hamm rented the first acres in North Dakota in the early 1980s. Over the next two decades, he was developing oil, although other investors gave up this idea in the period of low commodity prices. In 2012, Bloomberg called him a "Wild driller", the type of the "oil hunter", who is not afraid to take land on lease and start drilling, not knowing whether he will find oil or not. "I'm looking for oil – told Hamm. - In America, people have lost desire to drill wells. However, I'm a little more stubborn than other people are."

The next 20 years were not easy for Hamm, but his company survived two crash in oil prices, ruinous lawsuit by Occidental Petroleum and development of 17 empty wells in a row. Shale boom, which began at the turn of 2000-2010-ies, made Hamm rich. According to 2008 US Geological Survey, Bakken deposit contained 4.3 billion barrels in 2010. Continental introduced its own estimation - 24 billion barrels, almost twice as much as Prudhoe Bay.

Although Continental was not the first company to try the fracturing technology on Bakken, it was the developer of most of the fields in North Dakota: the area taken by it in the land lease was 3.64 sq.km. with 350 oil rigs - more than any other oil company. In 2013, the mine Bakken provided 10% of all oil production in the United States, where most of the work was carried out by Hamm. NBC News Channel even called him the billionaire, who ensured a "great revival of American oil."

Prior to the shale boom in 2009, the US produced 5.3 million barrels a day. In 2014, at its peak level, the production rose to 8.7 million barrels per day.

In 2014, Hamm appeared on the cover of the May issue of Forbes. According to an essay about him, the billionaire explains part of his success and the company’s "resistance" by strict accounting and cost control, including personal. Hamm’s favorite lunch place - a simple snack bar in Oklahoma. Continental Resources headquarters in an office building that formerly belonged to another large energy company - Devon. Continental bought it for $ 23 million. Forbes wrote that Hamm pays great attention to Continental’s efficiency - in 2014, the company had 950 employees compared to Devon’s 6.5 thousand and 11 thousand of Chesapeake Energy. At the time, Continental’s capitalization was comparable to Devon and was far ahead of Chesapeake. In January 2016, the staff of Continental Resources consist of 1188 people.

The cowboy leader

"I call American oilfields "cowboy camp" because of the people who have made our oil boom possible," - said Hamm last spring. "The land is characterized by oil derricks, rednecks, and protection of property rights" - said the billionaire to Forbes.

One of Hamm’s PR managers once said of him that people get "hammonized" just by talking to the billionaire. "Even many of his political opponents say that it is hard not to love him" - he said. However, many still see him as a typical "big industrialist." The Washington Post, which published a very complimentary portrait of his, was forced to admit that he, to say the least, is inclined to exaggeration. He once said that a McDonald's in the "slate capital" of America, Dickinson, North Dakota, is the second busiest in the world. Another time, he promised that the US Treasury could be extended with royalty to $ 12 trillion, if the oil companies got all oil-bearing federal lands on lease. Neither turned out to be true - in the latter case to provide the promised trillions, US oil industry should have been satisfying all of the global demand for raw materials during a quarter-century.

Hamm is a staunch Republican, and protects the freedom of entrepreneurship as he sees it by all means, demanding tax breaks for the oil industry. Until 2007, he did not interfere in politics, rather spending millions of dollars to support Republican candidates, and founded the Domestic Energy Producers Alliance (DEPA), which slogan is uninventive "Oil exports is a victory for America." In 2012, Hamm became an Energy adviser to the presidential candidate of the Republican Mitt Romney. Together with his wife, Hamm whipped round more than $ 2 million for him. Then Romney lost to Democrat Barack Obama, with whom Hamm couldn’t manage to build good relationship.

He recalled his meeting at the White House with Obama in 2012. He came up to the president, saying that the United States is full of its own oil. Obama waved him off. "It was like if you're from the oil and gas industry, you are waste of space" - injured Hamm retold the story Bloomberg.

The 70-year-old billionaire has already coped with a long period of cheap oil. Just like many high achievers, he sees the crisis not as a difficulty, but an opportunity for expansion. In Forbes’ ranking of "independence" to achieve wealth, Hamm assigned the highest score - 10. It means that a person could succeed with minimal starting opportunities.

"Wild Driller"

Born of the town of Lexington, Oklahoma, which population barely exceeded one thousand in the early 1960s, Hamm had to make a choice between being a farmer like his sharecroppers parents, or escape from the provinces and go to university. As he would say later, "I do not look back". He got married being 17 years old, and moved with his family to a bigger city Enid, where he got a temporary job. Cleaning and filling machines brought him a dollar an hour, which was enough to pay for an education loan.

In the early 1960s, North Oklahoma experienced an oil boom. Hamm was lucky - two years after graduating from high school, he managed to become an oilman in Champlin Oil with a fixed salary of $500 a month. "It was a job, which everyone wanted," - he later recalled. Already in 1967, Hamm founded his own oil company, Shelly Dean Oil Co., the predecessor of the current Continental Resources, 76% of which shares he possesses to this day.

The company’s first "office" was located in his Ford pickup truck. Bloomberg describes his working day: "During the day he was cleaning out the water from the oil reservoir, and in the early morning and late evening sitting with worn down by life drillers and learned to decipher the data of drilling logs." He drilled his first well in Oklahoma in the early 1970s, and the second well gushed with oil. Level of production from the second one reached 75 barrel a hour. "It was noticed by everyone," - he said to Forbes in 2012.

He spent money earned on the first oil on learning courses of geology, chemistry and mineralogy. Hamm did not get a university diploma, but that does not prevent him to consider himself as a geologist. He enthusiastically talks about rock porosity and is personally involved in analyzes of samples and planning exploration.

The company’s heyday fell on the 1990s, when Bakken oil field was discovered in North Dakota. This discovery was the largest since Prudhoe Bay in Alaska in 1968. However, developing demanded new technologies, precisely, hydraulic fracturing that would produce previously unavailable raw material. "He supports all new technologies, - told Bloomberg head of exploration units Jack Stark. - He rents a piece of land and tests the idea on the spot. Others are reluctant to act. "

"He's one of the smartest oil people, whom I met - confessed Lew Ward, Ward Petroleum Chairman, who knows Hamm since their youth in Enid. - He thinks and acts faster than an average person."

Hamm rented the first acres in North Dakota in the early 1980s. Over the next two decades, he was developing oil, although other investors gave up this idea in the period of low commodity prices. In 2012, Bloomberg called him a "Wild driller", the type of the "oil hunter", who is not afraid to take land on lease and start drilling, not knowing whether he will find oil or not. "I'm looking for oil – told Hamm. - In America, people have lost desire to drill wells. However, I'm a little more stubborn than other people are."

The next 20 years were not easy for Hamm, but his company survived two crash in oil prices, ruinous lawsuit by Occidental Petroleum and development of 17 empty wells in a row. Shale boom, which began at the turn of 2000-2010-ies, made Hamm rich. According to 2008 US Geological Survey, Bakken deposit contained 4.3 billion barrels in 2010. Continental introduced its own estimation - 24 billion barrels, almost twice as much as Prudhoe Bay.

Although Continental was not the first company to try the fracturing technology on Bakken, it was the developer of most of the fields in North Dakota: the area taken by it in the land lease was 3.64 sq.km. with 350 oil rigs - more than any other oil company. In 2013, the mine Bakken provided 10% of all oil production in the United States, where most of the work was carried out by Hamm. NBC News Channel even called him the billionaire, who ensured a "great revival of American oil."

Prior to the shale boom in 2009, the US produced 5.3 million barrels a day. In 2014, at its peak level, the production rose to 8.7 million barrels per day.

In 2014, Hamm appeared on the cover of the May issue of Forbes. According to an essay about him, the billionaire explains part of his success and the company’s "resistance" by strict accounting and cost control, including personal. Hamm’s favorite lunch place - a simple snack bar in Oklahoma. Continental Resources headquarters in an office building that formerly belonged to another large energy company - Devon. Continental bought it for $ 23 million. Forbes wrote that Hamm pays great attention to Continental’s efficiency - in 2014, the company had 950 employees compared to Devon’s 6.5 thousand and 11 thousand of Chesapeake Energy. At the time, Continental’s capitalization was comparable to Devon and was far ahead of Chesapeake. In January 2016, the staff of Continental Resources consist of 1188 people.

The cowboy leader

"I call American oilfields "cowboy camp" because of the people who have made our oil boom possible," - said Hamm last spring. "The land is characterized by oil derricks, rednecks, and protection of property rights" - said the billionaire to Forbes.

One of Hamm’s PR managers once said of him that people get "hammonized" just by talking to the billionaire. "Even many of his political opponents say that it is hard not to love him" - he said. However, many still see him as a typical "big industrialist." The Washington Post, which published a very complimentary portrait of his, was forced to admit that he, to say the least, is inclined to exaggeration. He once said that a McDonald's in the "slate capital" of America, Dickinson, North Dakota, is the second busiest in the world. Another time, he promised that the US Treasury could be extended with royalty to $ 12 trillion, if the oil companies got all oil-bearing federal lands on lease. Neither turned out to be true - in the latter case to provide the promised trillions, US oil industry should have been satisfying all of the global demand for raw materials during a quarter-century.

Hamm is a staunch Republican, and protects the freedom of entrepreneurship as he sees it by all means, demanding tax breaks for the oil industry. Until 2007, he did not interfere in politics, rather spending millions of dollars to support Republican candidates, and founded the Domestic Energy Producers Alliance (DEPA), which slogan is uninventive "Oil exports is a victory for America." In 2012, Hamm became an Energy adviser to the presidential candidate of the Republican Mitt Romney. Together with his wife, Hamm whipped round more than $ 2 million for him. Then Romney lost to Democrat Barack Obama, with whom Hamm couldn’t manage to build good relationship.

He recalled his meeting at the White House with Obama in 2012. He came up to the president, saying that the United States is full of its own oil. Obama waved him off. "It was like if you're from the oil and gas industry, you are waste of space" - injured Hamm retold the story Bloomberg.