Hundreds of billionaires dominate the small middle class in China, while the rest of the population lives on less than $ 1 a day. However, recent data suggest that a similar problem of inequality in the US has expanded much wider than in China.

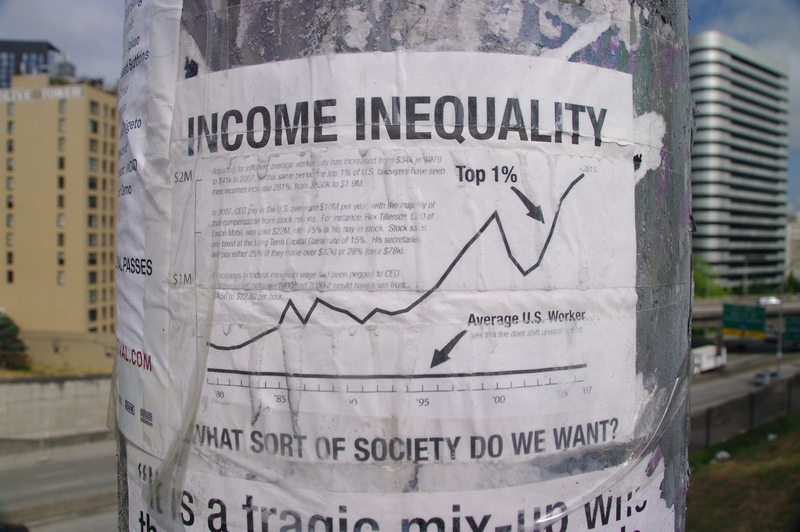

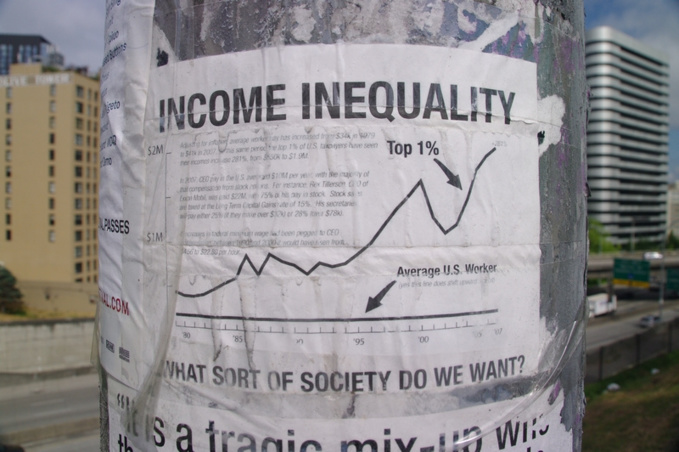

US National Bureau of Economic Research published a study, which indicates that income inequality in the United States and China has increased rapidly in the past few decades. In China, the richest 1% of the population received 13% of total income in 2015. The share has doubled since the 1980s. As for the US, the richest 1% of the population received 20% of total revenues – the figure has also doubled since the 1980s.

It should be borne in mind that calculation of income of the richest of China's population can be quite complicated, since most of their capital are hidden. Therefore, the report notes that the study takes into account the lower limit of possible income fluctuations, given how actively rich Chinese hide their money from the tax authorities and law enforcement agencies.

The paper is mainly focused on the lower part of the income pyramid. There is a wide gap between rich and poor, which indicates that the problem of inequality is much more pronounced in the US than in China. According to the analysis, proportion of income of "lower" 50% of the Chinese population (income of less than $ 9280 per year, taking into account purchasing power parity) fell from 27% in 1978 to 15% in 2015.

50% of American population with the lowest income (income of less than $ 36 thousand per year) experienced an economic collapse in the last 30 years. Share of their income in the total volume throughout the US has decreased from 20% to 12% in 2015, which is 3 percentage points lower than in China.

This confirms that inequality of income between the richest and the poorest half of the US population has grown faster than in some developing countries, primarily in China. Economists who prepared the study, say that this problem can be solved by equalizing distribution of primary assets, i.e. getting a better education, access to good working conditions and minimum wage.

Growth of the Chinese economy amounted to about 6.7% in 2016, according to preliminary estimates of the National Statistical Office of the PRC. China contributed more than 30% to rise of the global economy. Thus, the country remains a trailblazer of global GDP, said representatives of the department.

According to them, the Chinese economy in recent years developed a "new norm". Although the national economy is slowing down, its growth rate still remains quite high, said Xinhua agency.

In 2016, US GDP increased by 1.6 percent, showing a lower growth compared to the previous year.

According to PNC Bank economist Gus Faucher, the world's largest economy is feeling good, yet its performance is not impressive. He noted steady growth in consumer spending due to job growth and wage growth, which will lead to economic growth this year. Efforts to lower taxes and regulation may also have a beneficial effect thanks to improved business financing conditions. According to PNC forecasts, the US economy will grow by about 2.4 percent in 2017 year.

source: cnbc.com

US National Bureau of Economic Research published a study, which indicates that income inequality in the United States and China has increased rapidly in the past few decades. In China, the richest 1% of the population received 13% of total income in 2015. The share has doubled since the 1980s. As for the US, the richest 1% of the population received 20% of total revenues – the figure has also doubled since the 1980s.

It should be borne in mind that calculation of income of the richest of China's population can be quite complicated, since most of their capital are hidden. Therefore, the report notes that the study takes into account the lower limit of possible income fluctuations, given how actively rich Chinese hide their money from the tax authorities and law enforcement agencies.

The paper is mainly focused on the lower part of the income pyramid. There is a wide gap between rich and poor, which indicates that the problem of inequality is much more pronounced in the US than in China. According to the analysis, proportion of income of "lower" 50% of the Chinese population (income of less than $ 9280 per year, taking into account purchasing power parity) fell from 27% in 1978 to 15% in 2015.

50% of American population with the lowest income (income of less than $ 36 thousand per year) experienced an economic collapse in the last 30 years. Share of their income in the total volume throughout the US has decreased from 20% to 12% in 2015, which is 3 percentage points lower than in China.

This confirms that inequality of income between the richest and the poorest half of the US population has grown faster than in some developing countries, primarily in China. Economists who prepared the study, say that this problem can be solved by equalizing distribution of primary assets, i.e. getting a better education, access to good working conditions and minimum wage.

Growth of the Chinese economy amounted to about 6.7% in 2016, according to preliminary estimates of the National Statistical Office of the PRC. China contributed more than 30% to rise of the global economy. Thus, the country remains a trailblazer of global GDP, said representatives of the department.

According to them, the Chinese economy in recent years developed a "new norm". Although the national economy is slowing down, its growth rate still remains quite high, said Xinhua agency.

In 2016, US GDP increased by 1.6 percent, showing a lower growth compared to the previous year.

According to PNC Bank economist Gus Faucher, the world's largest economy is feeling good, yet its performance is not impressive. He noted steady growth in consumer spending due to job growth and wage growth, which will lead to economic growth this year. Efforts to lower taxes and regulation may also have a beneficial effect thanks to improved business financing conditions. According to PNC forecasts, the US economy will grow by about 2.4 percent in 2017 year.

source: cnbc.com