Financial Authority of Singapore sent to the local division of the Swiss bank BSI notice of withdrawal of its license due to "serious violations of money laundering legislation, ineffective management oversight of the banking operations, as well as gross violations committed by a number of the bank’s employees," according to the Ministry’s press release. This is the first case of a commercial bank’s license revocation in the country in 32 years, according to Bloomberg.

Today, the General Prosecutor's Office of Switzerland also opened a criminal case against BSI bank in connection with disturbances in the internal organization of the credit institution, stated in the agency’s press release. The case was initiated on the basis of information from the investigation ongoing against the Malaysian state investment fund 1Malaysia Development Berhad (1MDB).

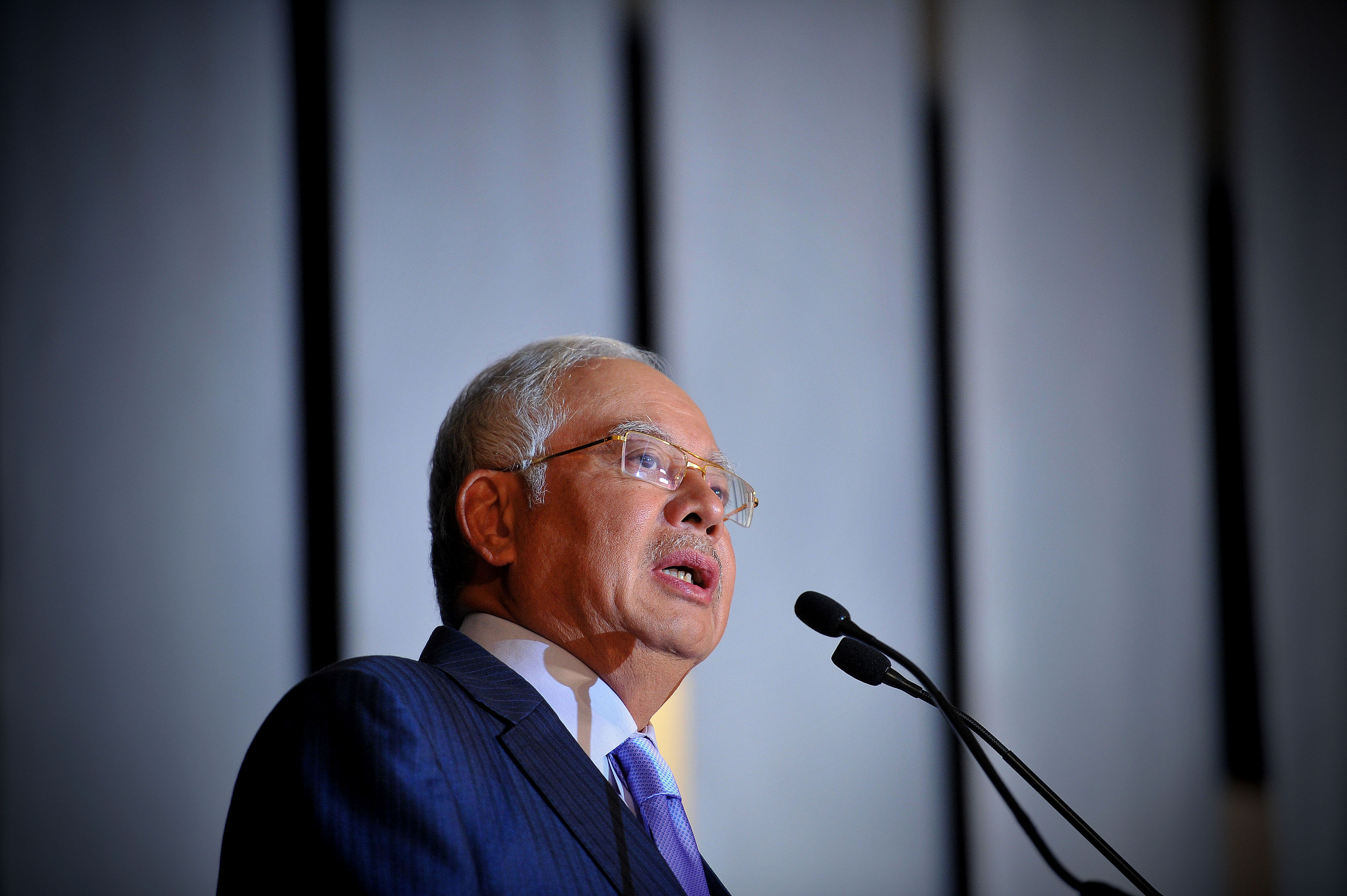

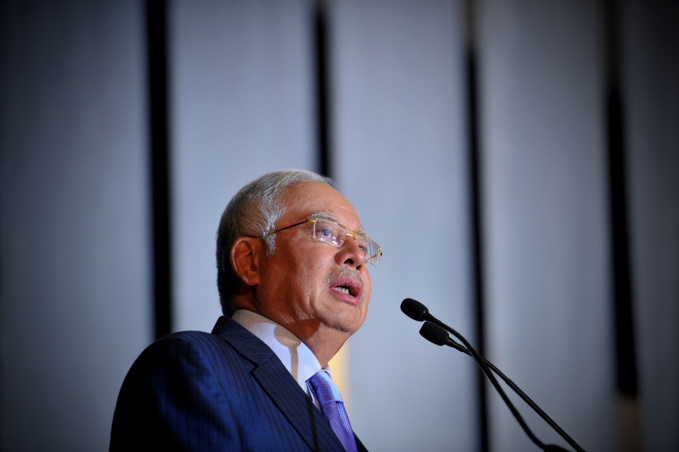

According to one of the Malaysian Parliament’s committees, amount of illegal operations effected by 1MDB amounted to at least $ 4.2 billion. The Committee recommended to disband State Fund-backed Advisory Board, headed by Singapore’s Prime Minister Najib Razak. 1MDB and Razak have consistently rejected charges of breaking the law.

In 2015, Razak was suspected of receiving $ 681 million from 1MDB. Malaysian Commission Against Corruption stated that it was a political donation from unspecified persons. At the end of January 2016, the Prosecutor's Office of Singapore found that a transfer to Razak’s personal bank account, which was discussed in the case, was in actual truth a gift from the Saudi royal family.

BSI Group’s CEO Stefano Coduri today announced his resignation. BSI said the bank is cooperating fully with the investigation in Switzerland and Singapore.

Founded in 1873, BSI (previously - Banca della Svizzera Italiana) is among the ten largest banks in Switzerland. It has 125,000 customers and $ 80 billion of assets under management. BSI has offices in Europe, Asia, Latin America and the Middle East.

source: bloomberg.com

Today, the General Prosecutor's Office of Switzerland also opened a criminal case against BSI bank in connection with disturbances in the internal organization of the credit institution, stated in the agency’s press release. The case was initiated on the basis of information from the investigation ongoing against the Malaysian state investment fund 1Malaysia Development Berhad (1MDB).

According to one of the Malaysian Parliament’s committees, amount of illegal operations effected by 1MDB amounted to at least $ 4.2 billion. The Committee recommended to disband State Fund-backed Advisory Board, headed by Singapore’s Prime Minister Najib Razak. 1MDB and Razak have consistently rejected charges of breaking the law.

In 2015, Razak was suspected of receiving $ 681 million from 1MDB. Malaysian Commission Against Corruption stated that it was a political donation from unspecified persons. At the end of January 2016, the Prosecutor's Office of Singapore found that a transfer to Razak’s personal bank account, which was discussed in the case, was in actual truth a gift from the Saudi royal family.

BSI Group’s CEO Stefano Coduri today announced his resignation. BSI said the bank is cooperating fully with the investigation in Switzerland and Singapore.

Founded in 1873, BSI (previously - Banca della Svizzera Italiana) is among the ten largest banks in Switzerland. It has 125,000 customers and $ 80 billion of assets under management. BSI has offices in Europe, Asia, Latin America and the Middle East.

source: bloomberg.com