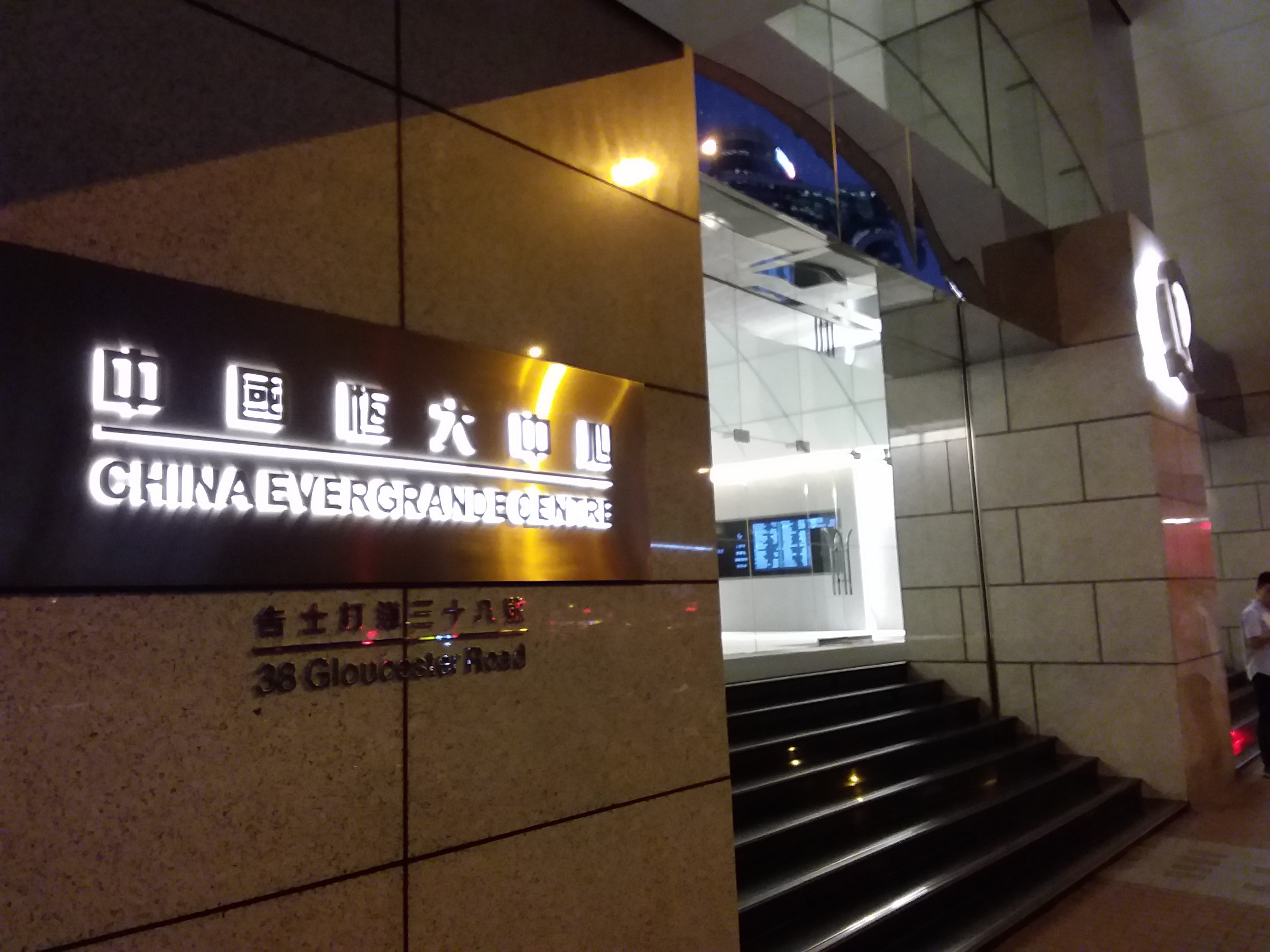

The directive was sent to the businessman shortly after the developer failed to make a payment on dollar-denominated bonds in late September. As the agency notes, the call to sort out the debts himself sends another signal that the authorities do not intend to bail out Evergrande, even if the collapse of the company would entail a crisis in the entire property market.

Mr. Xu was China's richest man back in 2017. At the time, his fortune was estimated at $42bn. However, amid the crisis, his fortune has shrunk to $7.8bn, according to Bloomberg estimates.

It should be noted that the debts of the Chinese property developer exceed $300 billion, and its subsidiaries have already defaulted on several loan payments. The company is experiencing a serious lack of liquidity, sales are falling, and most attempts to find investors and new lenders have failed.

However, last week the company repaid the debt on the overdue USD-denominated bonds, thus avoiding an October 23 default. In addition, the developer resumed work on ten sites.

source: bloomberg.com

Mr. Xu was China's richest man back in 2017. At the time, his fortune was estimated at $42bn. However, amid the crisis, his fortune has shrunk to $7.8bn, according to Bloomberg estimates.

It should be noted that the debts of the Chinese property developer exceed $300 billion, and its subsidiaries have already defaulted on several loan payments. The company is experiencing a serious lack of liquidity, sales are falling, and most attempts to find investors and new lenders have failed.

However, last week the company repaid the debt on the overdue USD-denominated bonds, thus avoiding an October 23 default. In addition, the developer resumed work on ten sites.

source: bloomberg.com